Why You Should Consider Engagement Ring Financing

How are you supposed to pay for an engagement ring?

Kind of like asking someone how much they make, this is one of those questions that is rarely asked, even among your inner circle. We think that should change.

After all, buying an engagement ring will likely be one of the most expensive purchases of your life–falling somewhere between a new iPhone and a new car–and both of those come with monthly payments, so why wouldn’t an engagement ring?

Thankfully, engagement ring financing is totally a thing, and it’s an option that many people take advantage of (even if they don’t broadcast it to the world).

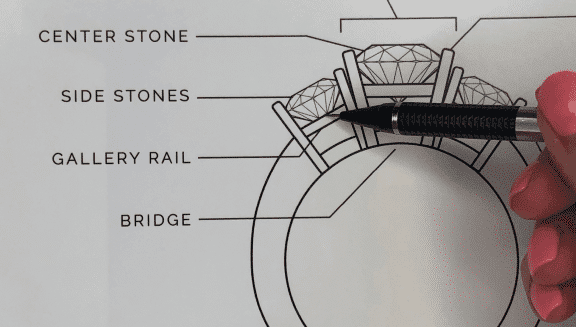

As a custom engagement ring designer, we work one-on-one with couples to make engagement rings from scratch, and this tends to be a pretty intimate process. What we’ve learned: there is a LOT of shame and hang ups around money/salary/and budget in society in general, and this gets amplified when it comes to paying for an engagement ring.

Let’s be clear: an engagement ring is not less meaningful if you pay for it over 12 months instead of all at once. So we’ve partnered with Synchrony to offer our clients 6, 12, or 18 month financing options with 0% interest and you can learn more about that here.

And regardless of where you end up finding an engagement ring, here are the reasons we’ve seen financing an engagement ring make sense for our clients, so you can see if it’s a good option for you.

Apply for Engagement Ring Financing Now

Engagement Rings Cost More Than You Expected

A recent survey by The Knot determined that half of Americans underestimated the cost of an engagement ring, and 2019 data from jewelry industry authority JCK shows that young millenials and Gen Z shoppers are even less aligned with this reality.

If you saved a chunk of money for what you thought a ring would cost, and it’s not enough, you are not in the minority.

Between the prevalence of “bargain” diamonds on the internet (AVOID THESE AT ALL COSTS), the public’s general distrust of the diamond industry, the learning curve associated with stone quality and the 4C’s, and antiquated formulas like the “three month rule,” getting to your magic number is no easy task and we see many clients pick a number but that doesn’t line up with the reality of what they want. It’s our job to educate you on what it really costs to make what you want, and oftentimes, that means breaking the news that, yes moonstone or turquoise cost way less than a diamond, but will crack and chip within the year. Still, the best decision for some couples is to buy a “right now” ring instead of one that will last forever, but just know that if you skimp now, you will end up replacing it. You get what you pay for, and if you want an engagement ring that’s going to last a lifetime, it’s an investment.

Knowledge is power and can save you from sticker shock. Read our no B.S. guide to engagement ring cost and download our comprehensive guide to engagement ring shopping.

Download 7 Things You Need to Know Before You Buy an Engagement Ring

You Cannot Eat or Live Inside an Engagement Ring

Have other financial goals beyond this piece of jewelry? Of course you do.

For many couples, getting engaged happens right around the same time that you’re planning a wedding and honeymoon, buying a house, paying off student loans, and thinking about having kids. Most of these things are put on plastic or turned into monthly payments. An engagement ring shouldn’t be any different.

Though we have seen clients go to great lengths to be able to pay for the ring in full because it meant a lot to them, in the hierarchy of needs, diamonds fall somewhere beneath food and shelter. Buy the non-negotiables now, finance the sparkly things.

You Don’t Want to Crack Your Nest Egg

Financing your ring does not equate to not having the money to pay for it. We offer financing to every single client, regardless of who they are or their lifestyle or job title, for a reason: Just because you’re financially able to pay for the entire ring in full does not mean you necessarily want to.

If you have a cushion in your bank account, it makes sense to want to keep it that way, especially with 0% interest financing and no incentive or savings associated with paying off the ring sooner.

You Want Less Stress

Planning the proposal, secretly shopping for a ring, and trying to budget for the ring, the wedding and everything else in your life can be stressful. Breaking up engagement ring cost into smaller payments can lighten the load. And if you are planning a surprise proposal, it may be easier to hide a small monthly fee to a financial institution from your partner than it is to hide a big lump sum from a business with the word “jewelry” in their name.

Read: How to Figure Out Her Ring Size, Secretly

There is No Right Way to Pay for an Engagement Ring

There are no awards given for purchasing an engagement ring the “right way”. There is no right way.

In fact, all of the following ways are totally acceptable, not taboo, and happen regularly:

- One half of the couple pays for the entire ring

- The couple splits the ring cost down the middle

- One half of the couple comes up with their max budget, and then the other half adds a little extra to get what they really want

- Parents contribute a little to the ring

- Parents contribute a lot to the ring

- Parents contribute heirloom jewelry to incorporate into the ring, which cuts costs

- The couple or individual uses financing or a layaway program

- It took them 5 years to save up

- It took one them one week to save up

- They pay in cash, with credit cards, debit card, or some combination

No matter your financial situation (which is truly none of anyone’s business) engagement ring financing is an option that makes sense for a lot of people. Even for clients who are able to pay for the entire ring in full, it might be better to save that nest egg or use it to pay off your student loans or pad your rainy day fund. Remember – you’ll tell the story of the proposal for the rest of your life, not the speed at which you paid for it.

Learn more about Abby Sparks Jewelry’s financing and layaway programs here.

Ready to design your own engagement ring? Book a free design meeting.

Comments